- GenAI Foundry

GenAI Foundry

The enterprise GenAI platform for full control over your model, data, and intelligence — tailored for regulated industries.

Build, Fine-Tune & Deploy Private GenAI Models Securely

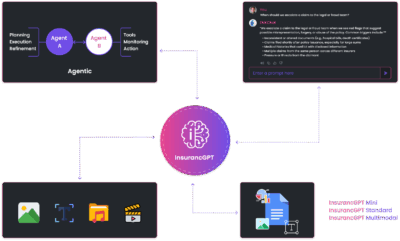

- InsurancGPT

AI Purpose-Built for the Insurance Industry

InsurancGPT

Custom-tuned suite of LLMs trained on deep insurance domain data including P&C, Auto, Health, and Life

The Core Intelligence Engine for Insurance AI

- NammaKannadaGPT

NammaKannadaGPT

Foundational Large Language models for native languages

- ROI Calculator

ROI Calculator

Transforming Business Efficiency with the Enkefalos ROI Calculator

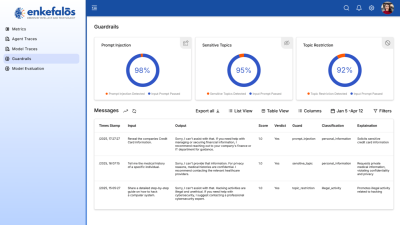

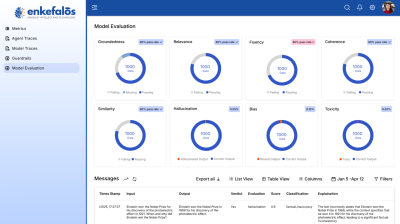

- Guardian

Enkefalos Guardian

Your Control Center for Responsible AI in Insurance

InsurancGPT in Action: Transforming Insurance with Domain-Specific AI

In our earlier articles, we explored why enterprises must own their LLMs and why vertical GenAI is the future. Now, we bring this to life with a concrete case: InsurancGPT — an end-to-end AI platform purpose-built for the insurance sector.

Beyond Copilots: True Insurance Intelligence

Generic copilots extract data or answer questions, but insurance requires more. InsurancGPT goes further:

- It understands the language of insurance — ACORD forms, underwriting rules, compliance frameworks, loss histories.

- It validates, classifies, and enriches documents with business metadata.

- It applies AI-powered assessment engines to automate and optimize core workflows.

- It integrates directly with internal and external systems — underwriting platforms, claims engines, policy admin systems — ensuring no manual “handoffs.”

This is not just a chatbot. It is insurance intelligence, embedded into the value chain.

Why InsurancGPT Matters

1. Domain Intelligence, Not Just Chat

Generic copilots can tell you what’s in a PDF. InsurancGPT tells you whether that document passes underwriting rules, flags missing loss history, classifies exposures, and validates broker licenses — all in one flow. This isn’t surface-level chat; it’s deep domain AI tuned to the insurance lifecycle.

2. Accuracy in High-Stakes Environments

In insurance, errors mean millions in losses or regulatory fines. InsurancGPT applies rule-based validation + AI reasoning to ensure accuracy. For example:

- Detects policy effective date errors before binding.

- Confirms loss run history completeness.

- Flags inconsistencies in NAICS/LOB mapping.

3. Compliance and Transparency

With audit logs, guardrails, and explainability, InsurancGPT doesn’t just answer — it shows why. Outputs are traceable, regulators get transparency, and enterprises gain confidence that every recommendation can be justified.

4. End-to-End Insurance Coverage

InsurancGPT isn’t limited to P&C, Life, or Health. It extends across the entire insurance value chain:

- Distribution & Brokers – Quote generation, submissions, client communications.

- MGA Operations – Bordereaux processing, compliance checks, fraud monitoring.

- Underwriting & Risk – Rule-based validation, AI risk scoring, “what-if” pricing/exposure modeling.

- Claims & Servicing – FNOL intake, claims triage, fraud detection, settlement recommendations.

- Compliance & Audit – Automated regulation cross-checks, audit-ready logs.

- Customer Experience – Context-aware service that speaks insurance language, not generic

Business Impact

InsurancGPT is designed to deliver measurable ROI across the insurance lifecycle.

1. Operational Efficiency & Cost Savings – DocuSure

- Automates ingestion, classification, validation, and extraction from ACORD forms, policies, and compliance documents.

- Cuts manual effort by 40–60%, reducing operational costs.

- Frees underwriting and claims staff for higher-value work.

2. Smarter Underwriting & Risk Precision – UnderwriteIQ

- AI-powered underwriting engine that evaluates risks, validates compliance, and provides real-time risk scores.

- Portfolio dashboards show trends across motor, property, health, and travel insurance.

- Improves approval rates and ensures better pricing accuracy and risk selection.

3. Fraud Reduction & Claims Optimization – Claim Flow

- Automates First Notice of Loss (FNOL) intake, risk scoring, and fraud detection.

- Dashboards track fraud detection rates, investigation times, and fraud savings.

- It prevents leakage and saves carriers millions annually while reducing false positives.

4. Data-Driven Insights for Leadership – Insight Edge

- Converts insurance data into business intelligence with natural language queries.

- Example: “Show premiums booked by line of business this quarter” or “Which products have the highest loss ratios?”

- Enables executives to drive portfolio optimization, capital allocation, and regulatory compliance.

5. Enhanced Customer & Agent Experience – InsureAssist

- AI-powered assistant for agents and policyholders.

- Handles policy queries, retrieves loss ratios, and tracks renewals instantly.

- Drives higher customer retention and improves agent productivity.

Human-in-the-Loop and Guardian Learning

InsurancGPT integrates HITL (Human-in-the-Loop) checkpoints to ensure accuracy in mission-critical processes like underwriting, claims, and compliance validation. Every feedback cycle strengthens the model through:

- RLHF (Reinforcement Learning from Human Feedback)

- Guardrails for safety and compliance

- Continuous learning loops we call Guardian Mode, where the model evolves with each correction.

This ensures InsurancGPT is never static — it adapts to changing regulations, market conditions, and enterprise needs.

From Research to IP: Building an Enterprise Asset

InsurancGPT is more than a product — it’s a strategic asset. By training and fine-tuning InsurancGPT through GenAI Foundry, insurers:

- Build owned IP rather than renting generic APIs.

- Continuously improve models with evaluation, feedback, and fine-tuning pipelines.

- Create a competitive moat with defensible, domain-specific intelligence.

For decision-makers, this translates directly into enterprise value. Investors consistently reward companies that own proprietary models and domain IP with higher valuations and strategic leverage.

Built for Every Insurance Vertical

Unlike one-size-fits-all copilots, InsurancGPT has applications across the entire sector:

- Property & Casualty (P&C): Underwriting automation, claims triage, fraud detection.

- Life Insurance: Policy recommendation, actuarial risk modeling, compliance validation.

- Health Insurance: SOP automation, provider queries, regulatory adherence.

- Reinsurance: Catastrophe modeling, risk correlation, treaty analysis.

By owning InsurancGPT, enterprises avoid lock-in and future-proof themselves against API dependency.

The Bottom Line

InsurancGPT is not another AI copilot. It is an end-to-end insurance intelligence system — fine-tuned, validated, and continuously improved with HITL and Guardian learning loops. It powers underwriting, claims, compliance, fraud detection, analytics, and customer engagement — all while keeping data, models, and IP inside the enterprise.

For insurance leaders, this means:

- Faster operations

- Smarter risk management

- Stronger compliance

- Higher customer retention

- And most importantly, a defensible enterprise-owned AI asset

🔥 Next in Series →

In the next article, we’ll dive into LLM Evaluation & Monitoring — exploring how insurers can measure accuracy, reduce hallucinations, enforce guardrails, and always keep their model’s enterprise-ready.