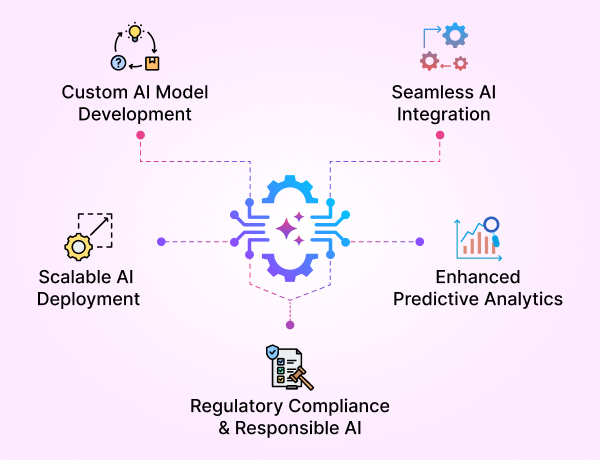

- GenAI Foundry

GenAI Foundry

The enterprise GenAI platform for full control over your model, data, and intelligence — tailored for regulated industries.

Build, Fine-Tune & Deploy Private GenAI Models Securely

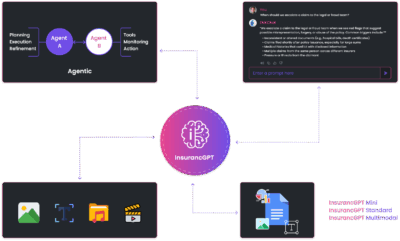

- InsurancGPT

AI Purpose-Built for the Insurance Industry

InsurancGPT

Custom-tuned suite of LLMs trained on deep insurance domain data including P&C, Auto, Health, and Life

The Core Intelligence Engine for Insurance AI

- NammaKannadaGPT

NammaKannadaGPT

Foundational Large Language models for native languages

- ROI Calculator

ROI Calculator

Transforming Business Efficiency with the Enkefalos ROI Calculator

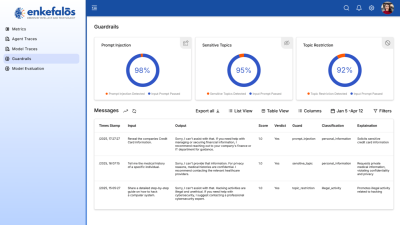

- Guardian

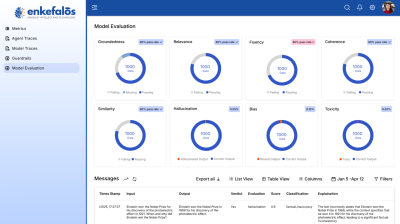

Enkefalos Guardian

Your Control Center for Responsible AI in Insurance

Transforming Insurance with Autonomous Intelligence

InsurancAgent Suite

Harnessing Agentic AI for the Insurance Industry

AI-Based Risk Modeling & Predictive Analytics

The insurance industry is undergoing a major transformation, driven by Artificial Intelligence (AI) and automation. However, traditional AI models often fall short in handling complex, dynamic workflows.

Agentic AI bridges this gap by introducing autonomous decision-making and adaptive learning capabilities, enabling insurers to streamline operations, enhance risk assessment, and improve customer interactions.

Agentic AI bridges this gap by introducing autonomous decision-making and adaptive learning capabilities, enabling insurers to streamline operations, enhance risk assessment, and improve customer interactions.

What is Agentic AI?

Agentic AI refers to AI-driven agents that operate autonomously, making real-time decisions based on evolving data patterns. Unlike traditional AI models that rely on static rule-based logic, Agentic AI continuously learns and adapts, optimizing business processes for efficiency and effectiveness.

Our Agentic AI Ecosystem

Built for real-world insurance operations — fully orchestrated AI agents running on top of your InsurancGPT models:

CX Agent

AI support agent managing real-time queries across web, email, and chat

Key Benefits

-

Handles routine inquiries instantly

-

Delivers consistent, personalized responses

-

Frees up agents for complex issues

-

Operates 24/7 without human dependency

ROI Impact

-

10–15% reduction in support workload

-

Boost in customer satisfaction and resolution speed

EnrollBoost

AI agent that re-engages users who abandon policy enrollment flows

Key Benefits

-

Tracks and identifies user drop-off patterns

-

Sends timely, personalized re-engagement messages

-

Supports agents with lead context and recommendations

ROI Impact

-

+15% lift in conversion

-

Lower cost per acquisition

ClaimsBot

AI assistant for fast, automated claim intake via image, document, or voice

Key Benefits

-

Accepts claims across multiple formats (chat, docs, voice)

-

Extracts data using OCR and NLP

-

Notifies customers instantly on claim status

-

Reduces back-and-forth with adjusters

ROI Impact

-

30–50% faster claims cycle

-

Fewer errors and lower operational costs

QuoteMate

AI assistant to guide customers in selecting and understanding insurance policies

Key Benefits

-

Matches users to policies via guided Q&A

-

Clarifies insurance jargon in real time

-

Integrates with CRM for personalized responses

-

Helps agents close deals faster

ROI Impact

-

Increased conversion rates

-

Faster onboarding, reduced drop-offs

UnderwriteGen

AI assistant that screens and summarizes insurance applications for underwriting

Key Benefits

- Streamlines pre-underwriting documentation

- Detects data gaps and inconsistencies

- Prepares structured summaries for underwriters

ROI Impact

- 40–60% reduction in underwriting time

- Improved consistency and fewer errors

AuditShield

AI system that checks documents against current insurance regulations

Key Benefits

-

Automatically checks content against current rules

-

Flags gaps and suggests corrective action

-

Reduces risk of audit findings and legal exposure

ROI Impact

-

Avoids penalties

-

Maintains audit readiness with minimal effort

RenewAI

AI agent that manages renewals and adjusts offers using customer history

Key Benefits

-

Proactively manages renewals

-

Adjusts offers based on sentiment and pricing elasticity

-

Increases chances of retention with targeted messaging

ROI Impact

-

Higher renewal rates

-

Reduced churn and manual follow-up

DocSense

AI tool that simplifies insurance documents and answers user questions

Key Benefits

-

Makes policy language easy to understand

-

Highlights key terms, exclusions,

and benefits -

Reduces dependency on support for document clarification

ROI Impact

-

Fewer inbound support queries

-

Faster customer decision-making

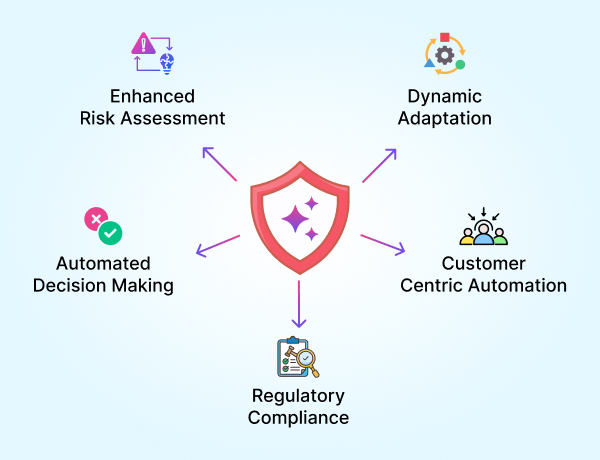

Key Benefits of Agentic AI for Insurance Enterprises

- Automated Decision Making: AI agents handle complex workflows, reducing manual intervention and improving operational efficiency.

- Enhanced Risk Assessment: Real-time data processing allows for more accurate underwriting and claims evaluation.

- Dynamic Adaptation: AI agents learn from past interactions and continuously refine their decision-making strategies.

- Customer-Centric Automation: Personalized policy recommendations and instant claim approvals enhance the customer experience.

- Regulatory Compliance: Ensures adherence to industry regulations through automated monitoring and reporting.

Example Use Case: AI-Driven ROI Calculator and Evaluation

One of the flagship implementations of Agentic AI by Enkefalos Technologies is in the ROI Calculator and Evaluation Tool. This proprietary solution evaluates the financial and operational impact of AI investments, ensuring that insurers achieve measurable value.

How It Works::

- Automated Data Ingestion: Collects and processes financial, operational, and customer data.

- Use Case Selection & Customization: Users can choose from predefined use cases or input their own custom scenario for evaluation.

- Task Volume & Completion Tracking: Users input estimated daily task volumes, completion rates, and other operational metrics.

- Agentic AI Execution: Multiple AI agents collaborate to analyze financial viability, search the internet for industry benchmarks, and perform complex calculations.

- Proofreading & Final Validation: A dedicated AI agent reviews the findings and finalizes the ROI report, ensuring accuracy and completeness.

- Actionable Insights: Provides insurers with AI-driven recommendations to maximize returns and efficiency.

Why Choose Agentic AI?

Scalability

Adaptable across various insurance functions, from underwriting to claims processing.

Customizability

Tailored to fit specific business needs and regulatory frameworks.

High Accuracy

Uses real-time and historical data to improve predictive analytics and decision-making.

Seamless Integration

Easily integrates with existing IT infrastructures, ensuring minimal disruption.

Embrace the future of insurance with Agentic AI

Agentic AI is redefining how insurance enterprises leverage AI-driven automation. By enabling real-time decision-making, adaptability, and intelligent risk management, Enkefalos Technologies empowers insurers to unlock new levels of efficiency and customer satisfaction.