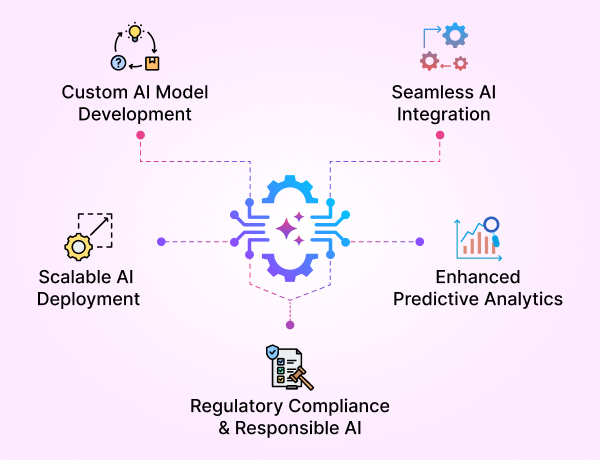

- GenAI Foundry

GenAI Foundry

The enterprise GenAI platform for full control over your model, data, and intelligence — tailored for regulated industries.

Build, Fine-Tune & Deploy Private GenAI Models Securely

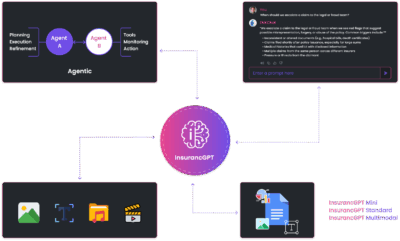

- InsurancGPT

AI Purpose-Built for the Insurance Industry

InsurancGPT

Custom-tuned suite of LLMs trained on deep insurance domain data including P&C, Auto, Health, and Life

The Core Intelligence Engine for Insurance AI

- NammaKannadaGPT

NammaKannadaGPT

Foundational Large Language models for native languages

- ROI Calculator

ROI Calculator

Transforming Business Efficiency with the Enkefalos ROI Calculator

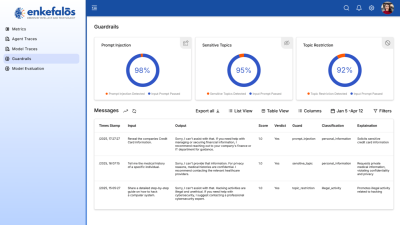

- Guardian

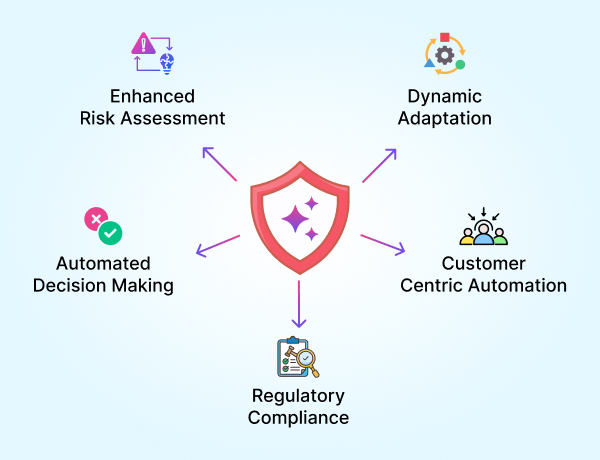

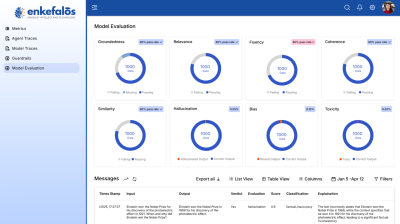

Enkefalos Guardian

Your Control Center for Responsible AI in Insurance

Transforming Business Operations with Intelligence

AI Driven Automation

Unlocking the Potential of AI Engineering in Insurance

Automation has long been a cornerstone of efficiency. However, traditional automation systems, reliant on rigid rule-based logic, are no longer sufficient in today’s dynamic business landscape. Enter AI-driven automation—a paradigm shift that combines artificial intelligence (AI) with automation to create systems that are not only efficient and scalable but also adaptive, intelligent, and decision-driven.

What is AI-Driven Automation?

AI-driven automation is the integration of artificial intelligence with traditional automation workflows, enabling machines to perform complex tasks autonomously, intelligently, and continuously learning from data. Unlike traditional robotic process automation (RPA), which follows pre-defined rules, AI-driven automation can:

- Understand patterns in structured and unstructured data.

- Make contextual decisions based on real-time information.

- Adapt to new scenarios without explicit programming.

- Optimize workflows through continuous learning and feedback loops.

This next-generation automation not only executes tasks but also enhances them, improving efficiency, accuracy, and cost-effectiveness across industries.

How AI-Driven Automation is Different from Traditional Automation

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

|

Feature |

Traditional Automation (RPA) |

AI-Driven Automation |

|---|---|---|

|

Approach |

Rule-based execution |

Data-driven, learning-based execution |

|

Flexibility |

Fixed processes |

Adaptive to new data and changes |

|

Decision-Making |

Requires human intervention for complex decisions |

AI-powered decisions in real time |

|

Scalability |

Limited to pre-defined tasks |

Expands capabilities through AI learning |

|

Data Handling |

Works with structured data only |

Processes both structured & unstructured data |

Traditional automation works well for repetitive, structured tasks, but AI-driven automation takes it one step further, allowing for intelligent decision-making, predictive analytics, and real-time adaptability.

Key Components of AI-Driven Automation

1. Machine Learning & AI Models

AI-driven automation leverages machine learning (ML) to detect patterns, make predictions, and adapt workflows dynamically. Instead of requiring human intervention, AI models continuously learn from past performance and refine processes over time.

2. Natural Language Processing (NLP)

AI-powered automation understands and processes human language, making it possible for chatbots, virtual assistants, and AI agents to handle customer interactions, document processing, and email automation efficiently.

3. Computer Vision & Image Recognition

By integrating computer vision, AI-driven automation can extract insights from images, documents, and videos- automating processes like ID verification, medical image analysis, and inventory tracking.

4. Autonomous AI Agents

Instead of simple task execution, AI-driven automation introduces autonomous agents that analyze real-time data, make contextual decisions, and optimize workflows dynamically- enhancing efficiency across multiple domains.

Real-World Applications of AI-Driven Automation

AI-Driven Automation in Insurance

Insurance operations are highly data-intensive, requiring extensive document processing, rating and quoting, policy analysis, and regulatory compliance. AI-driven automation enables insurers to improve:

Insurance operations are highly data-intensive, requiring extensive document processing, rating and quoting, policy analysis, and regulatory compliance. AI-driven automation enables insurers to improve:

1. AI-Powered Underwriting, Rating & Pricing Automation

- Risk Assessment & Pricing Models – AI analyzes historical data, market trends, and risk factors to automate underwriting decisions and pricing.

- Faster Policy Issuance – AI streamlines data extraction, document verification, and real-time underwriting, ensuring accurate policy approvals.

- Predictive Risk Segmentation – AI classifies policyholders into risk categories, ensuring precise pricing and fraud detection.

2. AI-Powered Rating & Quoting

- Automated Quote Generation – AI-driven algorithms analyze policyholder data and risk factors to generate accurate quotes instantly.

- Dynamic Pricing Adjustments – AI continuously updates pricing based on market fluctuations, risk data, and historical trends.

- Personalized Policy Recommendations – AI customizes insurance product offerings based on customer profiles and risk appetite.

3. Intelligent Claims Processing & Fraud Detection

- Automated Claims Adjudication – AI extracts claims data, cross-checks policies, and accelerates payout decisions with near-instant accuracy.

- Fraud Detection & Prevention – AI detects anomalies in claims, flags potential fraud, and reduces fraudulent payouts.

- Human-in-the-Loop AI – AI-powered automation supports claims adjusters by providing data-driven insights, allowing for faster and more accurate decisions.

4. AI-Powered Policy & Document Automation

- Automated Policy Processing – AI-driven models read, interpret, and validate insurance policies, reducing manual data entry errors.

- Regulatory Compliance Monitoring – AI continuously monitors policy documents for compliance with insurance regulations (GDPR, SOC2, HIPAA, IRDAI, etc.).

- Chat with Documents – AI-powered chatbots allow insurers to search, retrieve, and analyze policy details instantly.

5. AI-Driven Customer Experience & Agent Automation

- Agentic AI for Insurance – AI-driven assistants automate customer onboarding, policy recommendations, and service inquiries.

- AI-Powered Chatbots – 24/7 virtual assistants handle customer queries, claims tracking, and document submission, reducing call center loads.

- AI-Based Agent Matching – AI intelligently assigns agents to customers based on expertise, availability, and historical success rates.

Benefits of AI-Driven Automation

Increased Efficiency

AI speeds up repetitive and decision-based tasks, reducing process completion times significantly.

Higher Accuracy

Machine learning eliminates human errors, ensuring greater precision in decision-making and execution.

Scalability

AI-driven automation can scale effortlessly, handling increased workload without additional human resources.

Cost Reduction

By automating labor-intensive processes, businesses can cut operational costs while improving output.

Real-Time Decision-Making

AI continuously learns and makes adjustments based on real-time data, leading to faster, smarter business decisions.

The Future of AI-Driven Insurance Automation

With AI-driven underwriting, rating, quoting, claims processing, and policy management, insurers can scale operations, reduce costs, and improve customer experiences while ensuring compliance and efficiency. Enkefalos Technologies delivers custom AI solutions to transform insurance workflows into intelligent, automated systems.